- Underwrite.In

- Posts

- AI in Underwriting - The Future is Now

AI in Underwriting - The Future is Now

Simplified, sped up, accurate results

Microscope on the following

AI transforms underwriting by boosting efficiency.

Faster decisions, accurate risk assessment.

Reduce costs, enhance fraud detection.

Underwrite.In - leading AI underwriting platform.

AI is not a choice but necessity

In the world of insurance, the ability to accurately assess risk and make swift, informed decisions is paramount.

For decades, underwriting has been a labor-intensive process, relying heavily on manual data analysis and human expertise.

While invaluable, this traditional approach often grapples with inefficiencies, data overload, and the sheer volume of applications. But a new era is dawning, one powered by Artificial Intelligence (AI), and it's fundamentally reshaping how insurance companies operate.

Want to see which insurers are leading the charge in AI adoption? Check out the Gen Matrix Q2 2025 Report to discover the top AI-driven companies, innovators, and real-world applications transforming underwriting and beyond.

The Imperative for Change: Why AI Now?

The insurance landscape is on its toes! Customers demand faster responses, personalized products, and seamless digital experiences. Insurers, on the other hand, face increasing competition, complex risk profiles, and the need to optimize operational costs.

Traditional underwriting, with its inherent limitations, struggles to keep pace. This is where AI steps in.

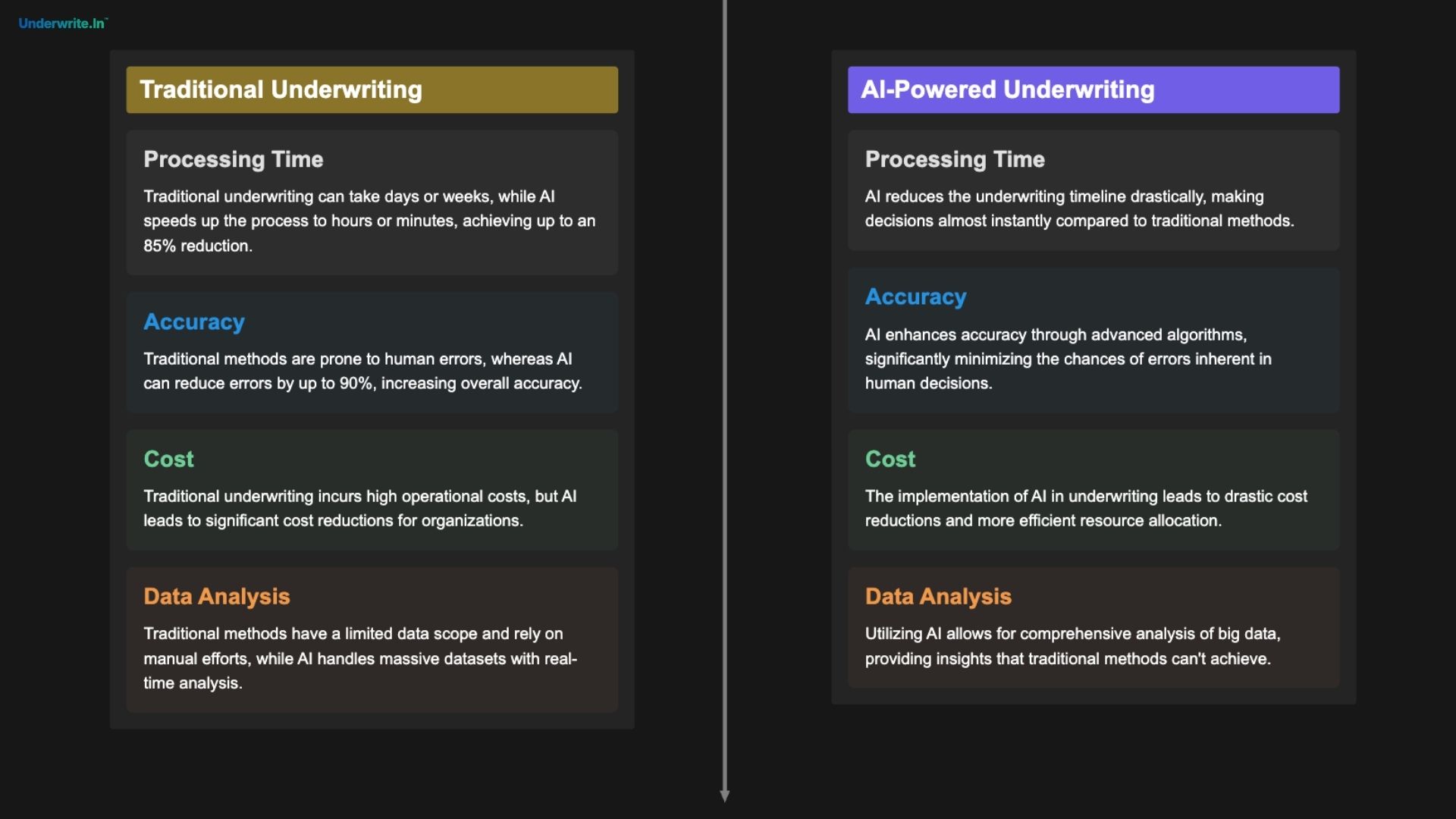

Traditional VS AI underwriting solutions

AI-powered solutions can analyze vast amounts of structured and unstructured data - from historical claims and medical records to social media and IoT device data at speeds and scales impossible for humans. This capability allows for -

Faster Processing

AI can significantly reduce underwriting time, leading to quicker policy issuance and improved customer satisfaction.

More Accurate Risk Assessment

By identifying subtle patterns and correlations in data that might escape human detection, AI improves the accuracy of risk assessment. One of the studies by McKinsey & Company suggests that AI can reduce errors in underwriting by up to 90%.

Cost Reduction

Automating routine tasks and optimizing workflows through AI can lead to significant reductions in operational costs.

Beyond Automation: The Power of Intelligent Underwriting

AI in underwriting is not just about automation; it's about intelligent automation. It's about empowering underwriters with insights that enable them to focus on complex cases, strategic decision-making, and building stronger client relationships. Consider these real-world impacts:

Enhanced Fraud Detection

AI algorithms can analyze application data and historical patterns to identify potential fraudulent activities with greater precision, helping insurers mitigate losses.

Personalized Products

With a deeper understanding of individual risk profiles, insurers can offer highly personalized products and pricing, catering to specific customer needs and preferences.

Improved Customer Experience

Faster processing times, tailored offerings, and more transparent decision-making contribute to a superior customer experience, fostering loyalty and trust.

Underwrite.In: Leading the AI Revolution in Underwriting

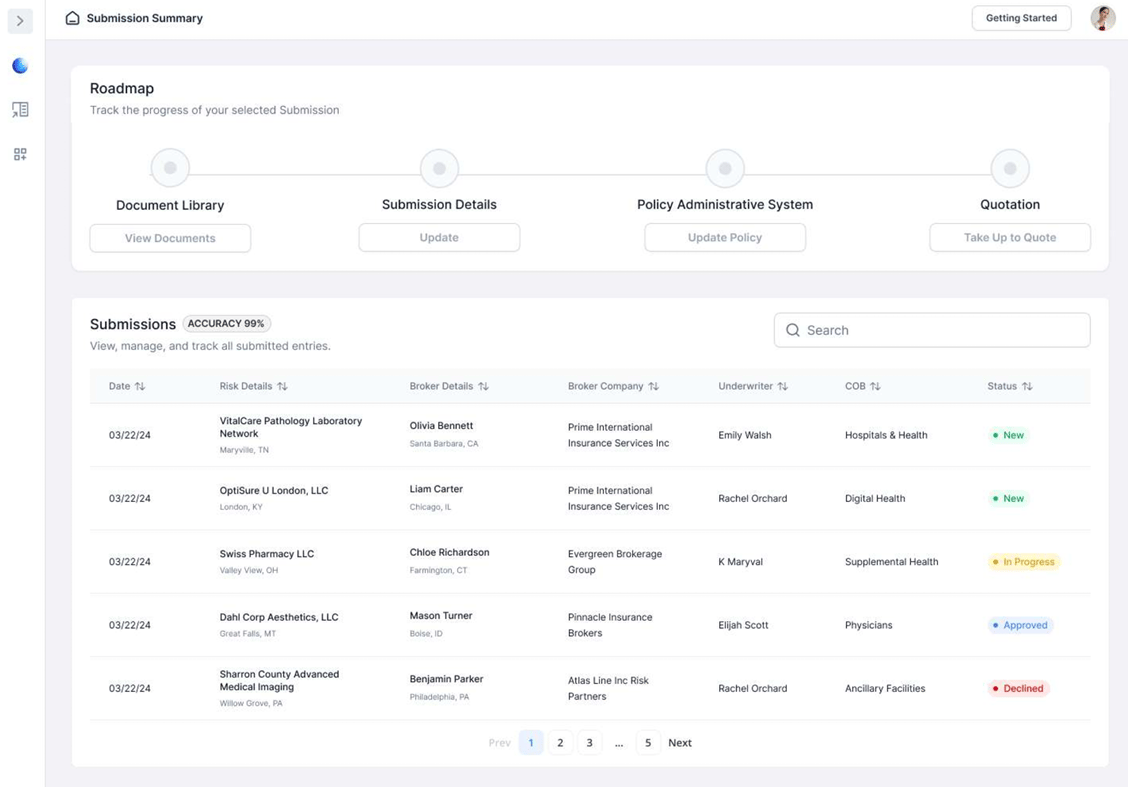

A glimpse of Underwrite.In

At Underwrite.In, we understand the challenges and opportunities presented by the rise of AI in underwriting. Our platform is purpose-built to empower insurance carriers and brokers with AI capabilities, transforming their underwriting operations from end-to-end.

We apply advanced AI to provide insurers with automated data handling and intelligent risk assessment that radically outperforms traditional underwriting approaches. Our comprehensive suite of features includes:

Automated Data Handling - From email initiation to data extraction, our platform automates every step of your data processing, minimizing manual intervention and maximizing efficiency.

Faster Decision-Making - Benefit from automatically generated concise summaries that highlight critical submission details, enabling quick and informed decisions.

Advanced Risk Assessment - Analyze claims history and trends to make data-driven decisions about coverage and premiums with unprecedented accuracy.

Full Document Access & Transparency - Access all tied documents in a secure, centralized repository for enhanced traceability and confidence.

You do not have an option other than embracing AI

So opt for a tool that cares about you and a solution that fits your needs (we mean Underwrite.In of course).

The integration of AI into underwriting is no longer a futuristic concept; it's a present-day necessity for insurers looking to remain competitive and relevant. While challenges such as data quality, integration with legacy systems, and ethical considerations exist, the benefits far outweigh the hurdles.

By embracing AI, your insurance company can unlock unprecedented levels of efficiency, accuracy, and customer satisfaction. It's about augmenting human intelligence with machine capabilities, creating a synergistic approach that drives superior outcomes.

And that is exactly what Underwrite.In thrives on.

Team Underwrite.In