- Underwrite.In

- Posts

- How Big Data is Reshaping the Insurance Landscape

How Big Data is Reshaping the Insurance Landscape

Revolutionizing Risk..

What’s in Today?

Everything about Big Data

Big Data + Underwrite.In, a partnership for ages

Big Data benefits for insurance companies

Ethical underwriting with Big Data

The insurance industry, traditionally rooted in historical data and actuarial science, is undergoing a profound transformation. At the heart of this revolution lies Big Data - the immense volume of structured and unstructured information generated daily. (Yeah, we know THE BIG DATA!).

This data, when harnessed effectively, empowers you to move beyond conventional risk assessment, enabling unprecedented precision, efficiency, and personalization in the insurance industry.

From refining policy pricing to enhancing fraud detection and streamlining claims, Big Data is not just optimizing existing processes; it's fundamentally reshaping how insurance decisions are made, fostering a more dynamic and responsive industry.

Big data is the ‘it’ thing right now, and here is everything you need to know about it.

Big Data and the Evolution of Underwriting

Underwriting, the soul of insurance, involves assessing risk to determine policy terms and premiums. Conventionally, this process has been labor-intensive, relying on limited data sets and manual analysis.

However, the advent of Big Data has ushered in a new era of precision underwriting, allowing you to analyze vast amounts of information from diverse sources, leading to more accurate risk assessments and personalized policies.

Big Data, combined with advanced analytics, machine learning (ML), and artificial intelligence (AI), enables you to develop new policies and reach new audiences

This shift is critical, as traditional insurance models often rely on outdated demographic information, leading to missed financial opportunities.

Underwrite.In is at the forefront of this transformation, revolutionizing underwriting operations with its AI-powered Assistant.

The platform automates routine tasks, optimizes data management, and delivers insights that empower faster, more informed decisions.

It applies advanced AI to provide insurance companies with automated data handling and intelligent risk assessment that radically outperforms traditional underwriting approaches.

But Why Only Underwrite.In?

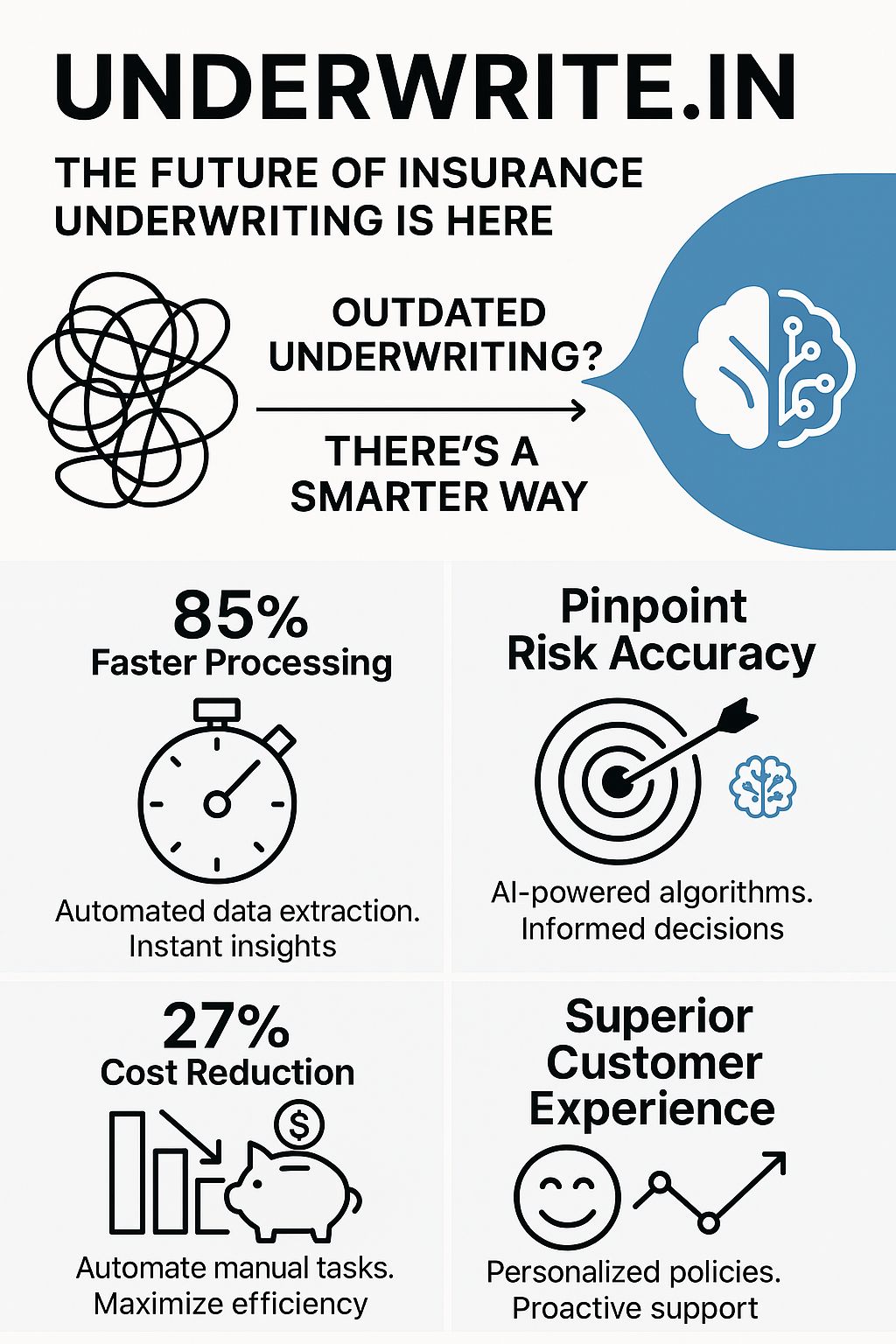

Faster Processing

Underwrite.In reduces your underwriting time by up to 85% . This efficiency is a direct result of automated data extraction and ingestion, which captures critical information from various sources, presenting it in one place.

More Accurate Risk Assessment

By incorporating data from multiple sources, your insurers can better evaluate applicants and make more informed decisions, resulting in lower risk and higher profitability (who doesn’t like big bucks).

Our AI specialists have developed proprietary algorithms specifically designed to understand and process insurance documentation with unprecedented accuracy, leading to improved risk assessment accuracy.

Cost Reduction

Automating manual processes drastically reduces the time and effort needed to manage claims and administrative tasks, leading to significant cost savings. You can see as big as 27% savings in operational cost.

Enhanced Customer Experience

Accurate risk prediction helps your team improve price policies and mitigate potential losses, benefiting both the insurer and the insured. By leveraging predictive analytics, your insurance firm can excel in risk management, balancing risk assessment and customer validation.

Underwrite.In's comprehensive suite of features, exemplifies how Big Data is transforming the underwriting process from end to end.

Big Data - A Weapon Against Insurance Fraud

Insurance fraud is a significant challenge for the industry, costing billions annually. In the U.S. alone, an estimated $308.6 billion is lost to insurance fraud each year.

Big Data provides you with powerful tools to combat this issue by identifying patterns and anomalies in claims that indicate fraudulent activity.

By analyzing vast amounts of data from various sources, including historical claims, social media, and public records, you can develop sophisticated predictive models.

These models can compare a person's data against past fraudulent profiles, flagging suspicious cases for further investigation. This proactive approach helps you reduce losses from fraud and lowers operational costs.

Personalizing Protection - Big Data and the Customer Experience

Beyond risk assessment and fraud detection, Big Data is fundamentally reshaping the customer experience in the insurance sector.

In an era where personalized experiences are paramount, your insurers need data to understand customer needs, preferences, and behaviors with unprecedented depth.

Such insights allow for the creation of highly tailored products, services, and marketing campaigns, fostering stronger customer relationships and increased loyalty.

Epsilon research indicates that 80% of consumers are more likely to make a purchase when brands offer personalized experiences. By analyzing past interactions, claims, and even external data sources like social media, your team can predict future coverage or service needs, offering proactive support that significantly boosts customer satisfaction

Streamlining Operations - Big Data in Efficiency and Claims

Beyond the core functions of underwriting and customer interaction, Big Data is also driving significant improvements in the operational efficiency of insurance companies and revolutionizing claims processing.

By automating manual processes and providing real-time insights, insurers can identify bottlenecks, streamline workflows, and improve overall productivity, leading to substantial cost savings.

In claims processing, Big Data streamlines the entire workflow, reducing processing time, improving accuracy, and enhancing customer satisfaction.

Automation and data analytics play crucial roles in this transformation, allowing for quicker investigations and reduced losses.

Ready to Embrace the Future of Ethical Underwriting?

At Underwrite.In, we believe that innovation and ethics go hand-in-hand. Our AI-powered platform is built with a commitment to fairness, transparency, and data privacy, ensuring that as you revolutionize your underwriting process, you also uphold the highest ethical standards.

We are dedicated to mitigating biases, safeguarding sensitive information, and providing clear insights into how data drives decisions.

Experience the power of intelligent automation that not only delivers unparalleled efficiency and accuracy but also champions responsible AI.

Team Underwrite.In