- Underwrite.In

- Posts

- Insurance doesn't need human underwriters anymore

Insurance doesn't need human underwriters anymore

And that's a myth...

Today, we are focusing on:

Underwriters aren’t becoming obsolete; they’re becoming strategic

How AI changes underwriting roles

Smartest things insurance teams are doing to upskill their people

See, every time AI shows up in a traditional industry, the same fear hits like clockwork:

“So…are humans still needed here?”

Insurance is no exception.

In boardrooms, underwriting floors, Slack channels - the question is quietly floating around:

“If AI can analyze submissions, score risks, and predict losses…do we really need human underwriters?”

Here’s the honest answer:

Not only do we need underwriters, we need better underwriters, who are more strategic, more judgment-driven, and more cross-functional.

Because here’s what the outside world often misses:

The hard part of underwriting has never been scoring a clean piece of business.

It is understanding the context around the risk, the intent of the insured, the behavior of a broker, and the macro signals that don’t fit neatly into a spreadsheet.

AI can surface patterns, but it can’t yet read between the lines of a renewal conversation, understand why a CFO suddenly wants changes to a policy, or sense when a sector’s risk appetite is shifting before the numbers show it.

What’s happening now isn’t replacement - it’s redistribution.

So, let’s find out how AI is changing underwriting roles.

How is AI actually changing underwriting roles?

The old picture of underwriting looked like this: endless document requests, cross-checking PDFs, digging through email threads, validating forms, and manually stitching together risk details from five different systems.

It was clerical labor wearing a technical job title.

AI doesn’t erase underwriting. It strips away the parts that never should’ve defined the job to begin with.

And when that happens, your underwriting team shifts from information gatherers into information interpreters.

That's where the real value begins.

These are some ways in which AI is changing underwriting roles.

Turning data collectors into risk interpreters

AI now handles the scanning, extraction, and summarization.

Your team finally steps into what underwriting was always meant to be: evaluating why a risk looks the way it does, not spending half the day figuring out what the risk even is.

So, now your team can finally start asking better questions like:

Does this business's loss pattern signal an operational shift?

Is the broker’s submission behavior quietly telling us something about their book quality?

Are we still pricing based on historical averages?

Those aren’t “system questions.” Those are commercial judgment questions.

And only humans ask them well.

This is the part most people outside insurance don’t understand: premium-worthy underwriting has never been about pulling scores from a tool.

It’s been about reading intent, understanding context, and identifying when the data is hinting at something deeper.

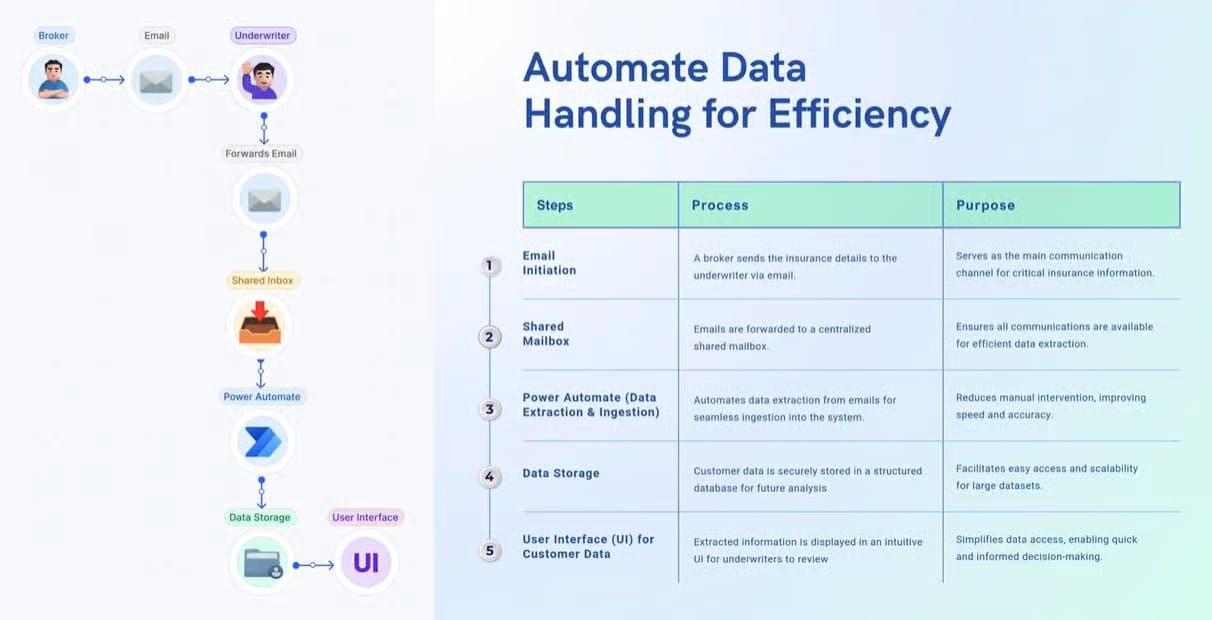

This is exactly why Underwrite.In exists to take the collect-clean-verify cycle off your team's plate.

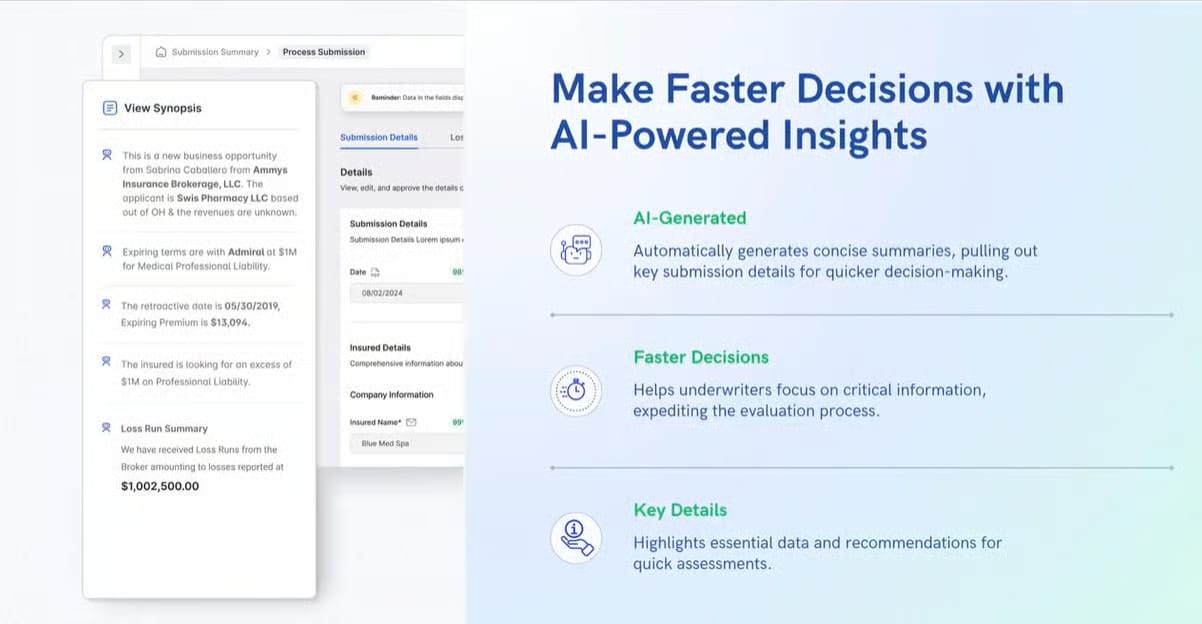

Instead of underwriters spending hours pulling data from emails, attachments, and broker PDFs, Underwrite.In auto-extracts key information, summarizes submissions, and highlights critical insights upfront, so your team enters the conversation informed.

Replacing transactional work with portfolio thinking

With manual grunt work off their plates, underwriting transforms from a “case-by-case conveyor belt” into a strategic function.

Underwriters now gain the mental bandwidth to step back and look at the book as a whole, connecting patterns and spotting signals that were previously buried in paperwork.

They start to notice subtle shifts like how brokers’ behaviors evolve month to month, emerging trends in claims frequency long before traditional loss triangles flag them, or industries quietly drifting from stable to risky ahead of renewal season.

Beyond that, AI can highlight correlations and anomalies across vast datasets, links between supply chain disruptions, climate events, or cyber incidents, and their impact on specific portfolios that human judgment alone might miss.

In this space, underwriters can act proactively by adjusting risk appetite, optimizing pricing, and steering the portfolio to mitigate potential losses while seizing opportunities. This is where true “portfolio thinking” happens.

Founders love talking about “proactive portfolio strategy,” but here, it’s tangible: a combination of AI-driven insights and human intuition transforming everyday underwriting into high-impact decision-making.

DataManagement.AI’s ‘RealTime Alerts & Notifications’ is a lifesaver as it provides stakeholders with instant, data-informed alerts when set conditions occur.

So, it cuts reaction time to minutes freeing teams from manual monitoring and paging.

Can the U.S. Win the Open Source AI Race? The Story of Two Competing Labs

Turning rule followers into risk innovators

With AI handling routine processes and highlighting critical signals, underwriters are no longer confined to rigid guidelines or historical precedent.

Instead, they can experiment with new coverage structures, test unconventional risk models, and explore market gaps that were previously too complex to evaluate.

This shift transforms underwriters from rule followers into risk innovators, capable of shaping products and strategies rather than simply executing them.

For example, AI can surface nuanced correlations like how a minor operational change in one segment may cascade into broader risk exposure across a portfolio, allowing underwriters to design coverage that anticipates these shifts.

Similarly, trends in broker submissions, claim anomalies, or emerging operational patterns are no longer just inputs; they become levers that underwriters can act on to proactively influence pricing, capital allocation, or risk appetite.

Underwrite.In supports this transformation by not just feeding clean data, but by contextualizing it: highlighting signals that indicate emerging risk behaviors, operational shifts, or market opportunities.

Smartest things you can do to upskill your underwriting team

As AI reshapes underwriting, insurance teams recognize that technology alone isn’t enough.

To stay ahead, leading teams are reimagining professional development, not just as a checkbox on compliance, but as a core business strategy.

Here are a few things that they are doing:

Risk interpretation training

You can teach your team to move beyond historical averages and technical scoring to understanding context, behavior, and intent.

For example, instead of simply checking whether a business meets predefined metrics, underwriters are trained to read subtle patterns: why a broker is submitting certain risks, whether a claims trend signals operational shifts, or how macroeconomic changes could affect exposures.

These skills will allow underwriters to turn AI-generated insights into actionable strategies, bridging the gap between raw data and commercial judgment.

Cross-functional rotations and exposure

You can rotate your underwriters across actuarial, product, risk, and distribution functions.

This will expose them to portfolio-level thinking, product innovation, and client dynamics. By seeing the business from multiple angles, underwriters learn how their decisions affect pricing, capital allocation, and market competitiveness.

Scenario-based learning

Instead of focusing purely on compliance or technical accuracy, you can make your team create simulations based on emerging risks or unusual broker behavior.

Underwriters can practice evaluating these complex scenarios using AI insights as a starting point, then applying judgment to make strategic decisions. This not only builds confidence but also sharpens decision-making skills in situations where data alone can’t provide answers.

Ongoing data literacy and analytics training

You should make your team learn how to interpret AI outputs critically, identify anomalies, and ask questions that drive portfolio-level strategies.

Tools like Underwrite.In don’t just feed clean data, they contextualize it, highlighting operational or market signals.

Your team should know how to interact with these insights effectively, transforming AI outputs from static reports into living, decision-making tools.

And here’s the practical takeaway: all of this is easier when the repetitive, time-consuming tasks are handled by AI.

By letting Underwrite.In take over data collection, extraction, and verification, your team can focus fully on interpreting risks, making strategic decisions, and driving portfolio-level impact.

When the tedious work is off their plates, your underwriters can truly put their skills to work, innovate, and contribute where it matters most.

Team Underwrite.In