- Underwrite.In

- Posts

- Insurance reports looking a mess? 3 mistakes to avoid

Insurance reports looking a mess? 3 mistakes to avoid

Unlocking deeper insights in your underwriting process before your competition does.

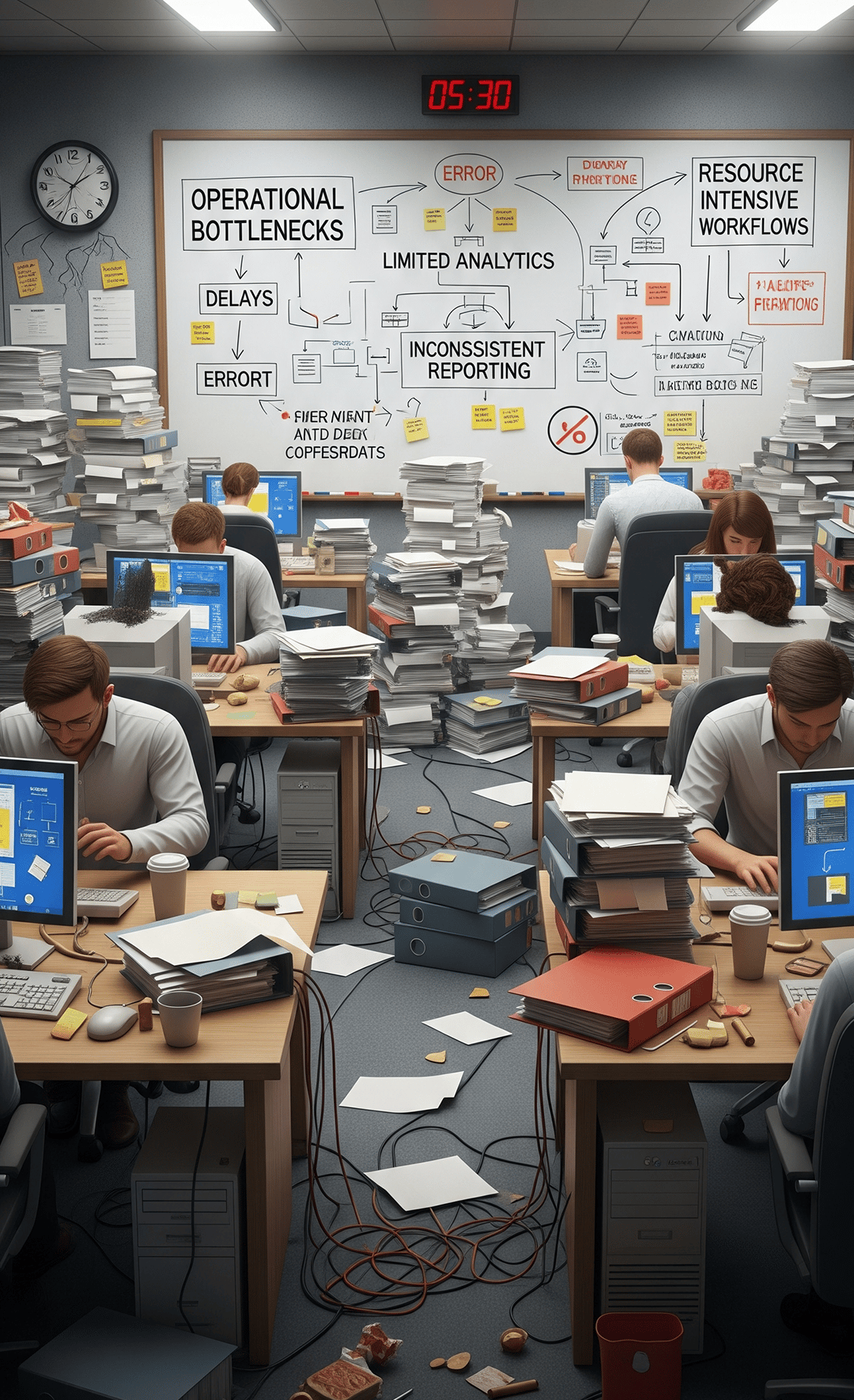

Remember how reports were made traditionally?

Stacks of paper printouts and excel spreadsheets. Hours to compile and days to analyze.

What’s missing today is how underwriting intelligence is captured. How that intelligence is analyzed and acted upon.

The question is not whether you need better reporting tools. The question is can you afford to operate without them? Traditional manual processes create bottlenecks. Inefficiencies lead to missed opportunities.

Legacy underwriting also struggle with poor data handling, lengthy processing times, and limited analytical capabilities.

Traditional underwriting reporting requires manual data extraction. Then validation and finally compilation across multiple sources.

Today it’s a hyper-competitive insurance landscape. Processing speed meets analytical depth.

That’s why, we at Underwrite.In, have built an AI-powered solution that delivers custom intelligent automation and accurate risk assessment for underwriters.

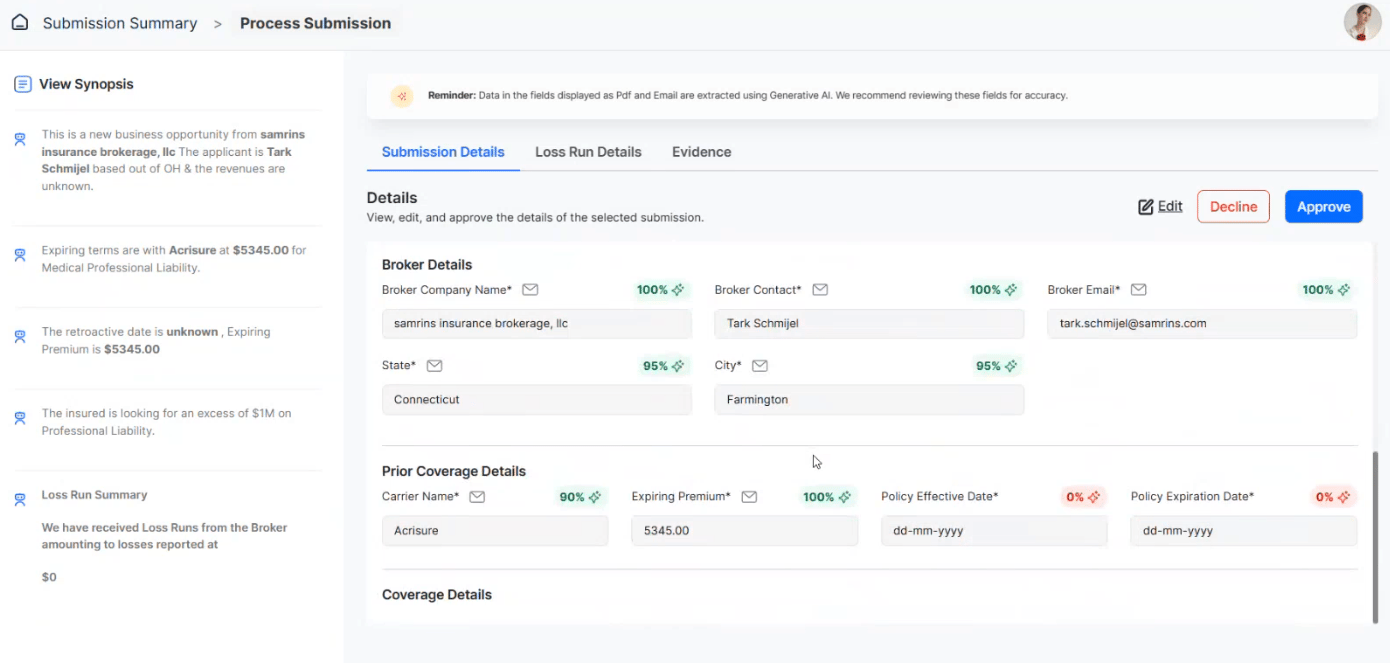

A quick view on how Underwrite.in's ease your decision making with enhanced reports.

The platform automatically processes and analyzes complex insurance data. Not just that, you can extract actionable insights from documents with precise accuracy.

No more extensive manual intervention. Your underwriting team now has clean and structured reports that highlight critical risk factors.

Don’t believe us? Let’s look at a study.

AI-based automation reduces the time needed to process insurance submissions by as much as 70%.

Also, according to IndicoData, AI-powered agents reduce underwriting costs by up to 40%.

Take Zurich Insurance Group’s example for context

Zurich Insurance Group is one of the world's largest insurance companies. They operate in over 210 countries.

Lack of deeper insights made it harder for them to maintain accuracy and speed in their underwriting risk assessment. Plus, the underwriting team were feeling demotivated with unending inaccuracies despite giving it their best.

Then ZIG decided to try an AI-powered underwriting solution. The advanced AI applications led to accurate and efficient evaluations.

This not only improved the quality of their underwriting risk assessments but also accelerated the underwriting process.

Looking for a similar AI-powered solution?

Your underwriting process could speed up and look somewhat like the screenshot below.

Actual working dashboard screenshot for Underwrite.In

Underwrite.In will give your underwriters the opportunity to automatically extract key data points. They can perform risk analysis and generate detailed reports in minutes rather than days.

The Zurich Insurance Group now processes 3x more applications with greater accuracy. The underwriters in their team are focusing on strategic decision-making rather than data compilation.

Customer satisfaction improved dramatically with faster turnaround times, while the underwriting team regained work-life balance and professional fulfillment through meaningful, high-value activities.

Their productivity goes up. Team is happy. You’re happy. Happy ending.

Still need convincing?

Traditional bottlenecks in manual underwriting.

Similar to Jordan, do any of the following pain points impact your underwriting reporting process?

Manual data processing creating overwhelming operational bottlenecks and delays?

Are limited analytical capabilities resulting in poorer risk assessment accuracy?

Are inconsistent reporting standards leading to compliance and quality control issues?

Resource-intensive workflows draining productivity and increasing operational costs?

Automation will only get you so far.

The insights still remain human, but you get them from our intuitive dashboard.

Speaking of dashboards, if you’re data is overwhelming, coming from varied sources, and needs clarity, then we have a data management tool for you.

These are the detailed insights that allow underwriters to make decisions in real-time.

Meanwhile, the four benefits that soothe the above pain points, using enhanced reporting are,

Automated extractionNo more manual data entry. Intelligent automation enables extraction of relevant data points. Perform comprehensive analysis in minutes. | Enhanced risk assessmentEasily analyze historical data patterns. Identify subtle risk indicators, and predict future claim probabilities with remarkable precision. |

Standardized data qualityNow, standardize workflows and reporting templates. Every application receives consistent evaluation according to your predefined criteria. | Resource optimizationAutomate routine tasks to let underwriters handle significantly more cases without sacrificing quality. New underwriters become productive faster. |

A solution for you

Underwrite.In’s automated reports is a shift.

It makes your life easier by integrating into workflows. It takes care of efficiency, transparency, and compliance.

“AI has the ability to discern patterns in ways and in data sets where humans simply cannot, or they simply just don't have the capacity to look at ginormous data sets and tease out various patterns. That's what AI can do very successfully.”

You see deeper insights related to data processing, risk assessment, compliance, and resource utilization.

You see measurable improvements - in speed, accuracy, and cost efficiency.

Reports That Go Beyond Charts & Numbers

Underwrite.In’s enhanced reporting presents prioritized insights. These insights support your underwriting decisions.

You choose this enhanced reporting to,

filter noise from signals, finding only the most relevant information in digestible formats.

reduce cognitive load on your underwriters.

gain access to comprehensive risk intelligence when making critical coverage decisions.

I suggest you schedule a personalized, one-to-one demo with our underwriting experts to see how you can generate maximum insights from your data.

We'll show you exactly how a real insurance claim submission flows within your system, from email receipt to AI-assisted decision-making. No buzzwords, no complexity, just the complete underwriting transformation that gives your underwriters their time back to become more effective.

The new regular

What’s new? Your reporting going on autopilot.

You see interactivity.

This interactivity allows for quick slicing and dicing of data. You see key metrics, and the ability to drill down into specific details without requesting new reports.

The new regular is also simplicity.

It’s an always-current reporting experience.

Data is not just data. It’s now a strategic asset. You now have a powerful advantage. You react according to the competitive market.

Want to skip waiting for a subordinate to prepare a long compliance report by EOD? Get it automated in seconds.

Team Underwrite.In