- Underwrite.In

- Posts

- Revealed: You are losing customers because of this one mistake!

Revealed: You are losing customers because of this one mistake!

But we got a solution...

Quick check for your underwriter team:

How many submissions still start in an inbox?

How many fields get re-typed into a system of record?

How often do docs go missing between broker, underwriter, and ops?

If those numbers sting, then there’s an integration gap that your competitors are closing right now.

You need an integration-first software right now

But why?

Let’s cut to the chase.

Your team doesn’t need another tool that promises speed but leaves chaos in the process.

Because…

📌Speed without clean handoffs just means rework.

📌And “smart” scoring without traceable data means audit trouble

What your team really needs is a platform that snaps into the systems they already use, like email, shared mailboxes, RPA flows, storage, and the underwriter’s workbench.

That way, decisions aren’t just fast, they’re searchable, defensible, and repeatable, and no extra time is spent on learning.

Accenture: 79% of insurance executives say poor integration between tools is their biggest barrier to efficiency.

Also, poor claims experience “could put up to $170B of global insurance premiums at risk by 2027.”

That’s why Underwrite.In was designed to meet your workflow where it already runs.

How does Underwrite.In fit into your stack?

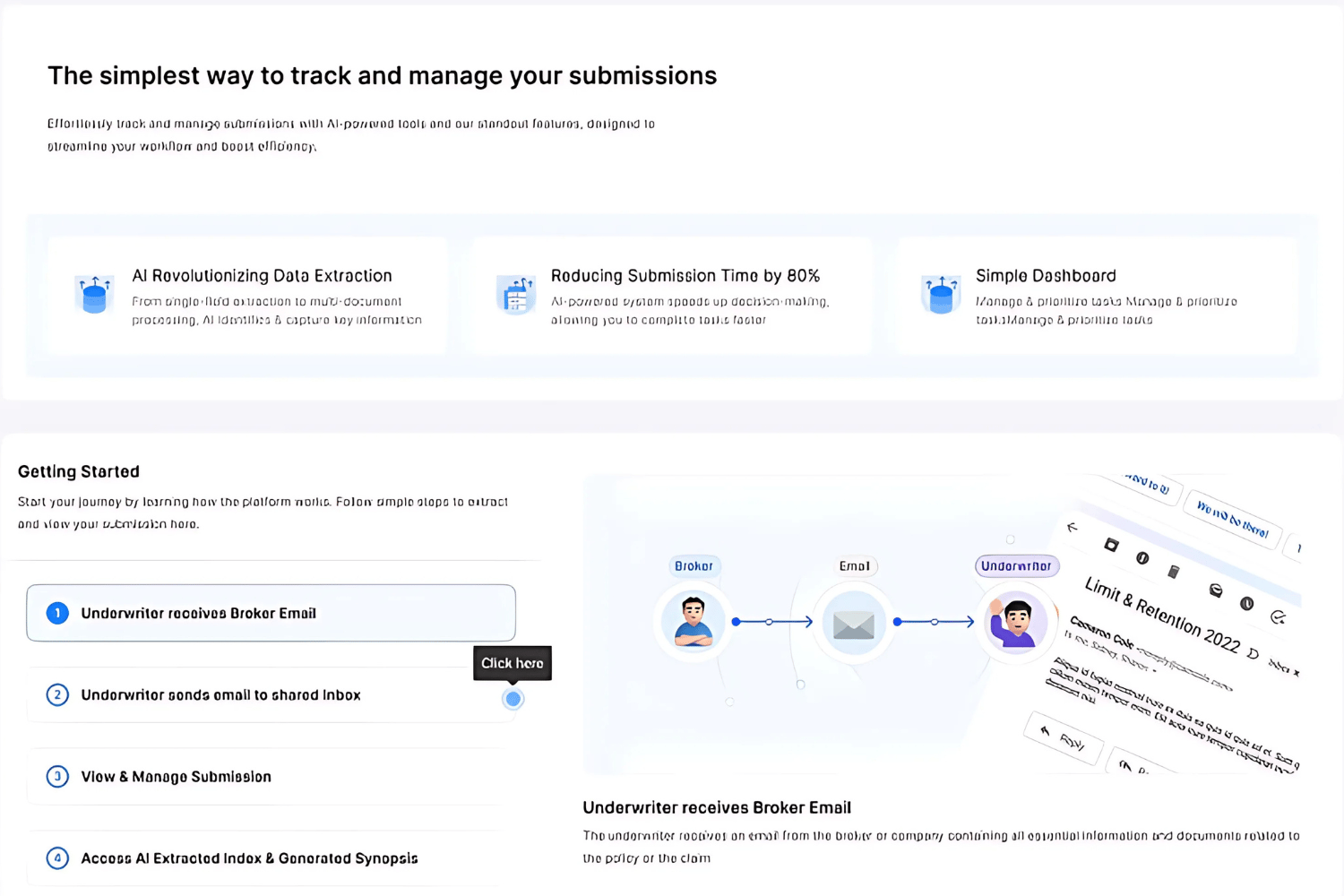

1) Email initiation - We capture every submission right at the edge

Every underwriting process starts with a broker’s email pack.

Instead of relying on manual forwarding or scattered inboxes, Underwrite.In plugs in at the source.

It automatically captures the full submission (message body, attachments, and even timestamps) so your team never loses critical data.

Bonus: This creates a clean audit trail and keeps SLA clocks accurate from the very first touchpoint.

Instead of juggling ten personal inboxes, everything routes into a single, centralized mailbox.

Your team works from the same queue, eliminating the hunt for scattered messages.

This is where duplication gets cleaned up, and where consistent, reliable service levels begin.

A major carrier's triage team now starts every case with flagged gaps and sorted docs instead of five tabs and guesswork.

It's automation that creates space for judgment instead of replacing it.

3) Power Automate (data extraction + ingestion) - This kills the copy-paste

An automation layer lifts key fields from emails and attachments and ingests them straight into your workflow (forms, ACORDs, PDFs, or spreadsheets).

An automation layer lifts key fields from emails and attachments and ingests them straight into your workflow (forms, ACORDs, PDFs, or spreadsheets).

Thus:

📌 Field-level confidence scores surface instantly

📌Exceptions get routed to review, instead of getting buried in threads

📌Manual re-keying drops to near zero, which is why accuracy improves

4) Structured data storage - It’s built to scale from day one

Every piece of extracted information is stored in a secure, structured database, so your team isn’t just capturing data; they’re curating it.

That means instant queries for pricing, triage, management insights, or model training.

And because clean lineage is preserved, your audit trail stays watertight while portfolio-wide views are always just a click away.

5) Underwriter UI - It’s built for decisions

Instead of chasing scattered files, your team lands on one clean, intuitive screen.

Every extracted field is shown with a confidence score, every datapoint links back to its original source, and every action is tracked.

This results in faster cycle times and a consistent underwriting record, without forcing your team to relearn how to work.

And, what changes for your team from Day 1?

✅Submissions stop getting fragmented across personal inboxes

✅Re-keying drops, review time compresses, and SLAs stabilize

✅Every data point gains a source link, so sign-offs get easier

✅Your data finally becomes model-ready for clustering, graphs, and causal analysis

Also, teams using Underwrite.In routinely see measurable gains:

85% faster processing

60% lower handling costs

And 3x higher field-level accuracy

…once the integration is live.

Ready to see your own inbox light up?

Run our “from email to decision” demo with your team’s real documents. Seats fill fast.

Team Underwrite.In