- Underwrite.In

- Posts

- The #1 workflow upgrade that makes claim processing 85% faster

The #1 workflow upgrade that makes claim processing 85% faster

See how top carriers are doing it

What we will talk about today

Why rigid underwriting workflows are slowing teams down

How Underwrite.In helps customizable workflows cut cycle times by 40%

Underwriting is already a high-stakes game.

Every submission is a mix of missing fields, unstructured docs, and time-sensitive decisions.

Now imagine running all of this on rigid workflows - the kind that don’t adapt when a client adds a new line of business, or when regulations shift mid-year.

It’s not just frustrating, it’s costly. Every time a process drags, submissions pile up, decisions slow down, and opportunities slip through.

For growing teams, that’s a revenue leak.

How Underwrite.In tailors to your team

Here’s what you get when you let us help ease your workload:

System fit without friction

Your IT team connects Underwrite.In to broker portals, mailboxes, or data feeds.

As soon as submissions land (email, PDF, spreadsheets, portals), the platform ingests them automatically.

The system parses data, maps it to your underwriting fields, and flags missing/uncertain entries with confidence scores.

What will your team get?

A unified queue of clean submissions in your existing UI - no toggling between five systems.

Something you should know:

Insurers who add automation & integration in underwriting report up to 50% reduction in processing time and around a 30-45% drop in manual data entry errors.

AI-powered synopsis

Each new submission is condensed into a short, AI-generated summary.

The system highlights retroactive dates, premiums, insured details, and prior carrier info.

Loss run summaries are pre-attached for quick scanning.

What will your team get?

A “View Synopsis” box that captures everything you need in under 30 seconds, instead of scrolling through 50+ pages of docs.

Risk context at a glance

The platform pulls prior claims (internal + external sources if connected).

It structures them by status (open/closed), severity, coverage type, and payments.

Trends and totals are auto-calculated (e.g., 3 claims = $1,002,500).

What will your team get?

A structured claims summary with totals and trends, which they can then use to gauge risk

Reality check:

Carriers that invested in flexible underwriting workflows saw a 15–20% increase in submission-to-bind ratios

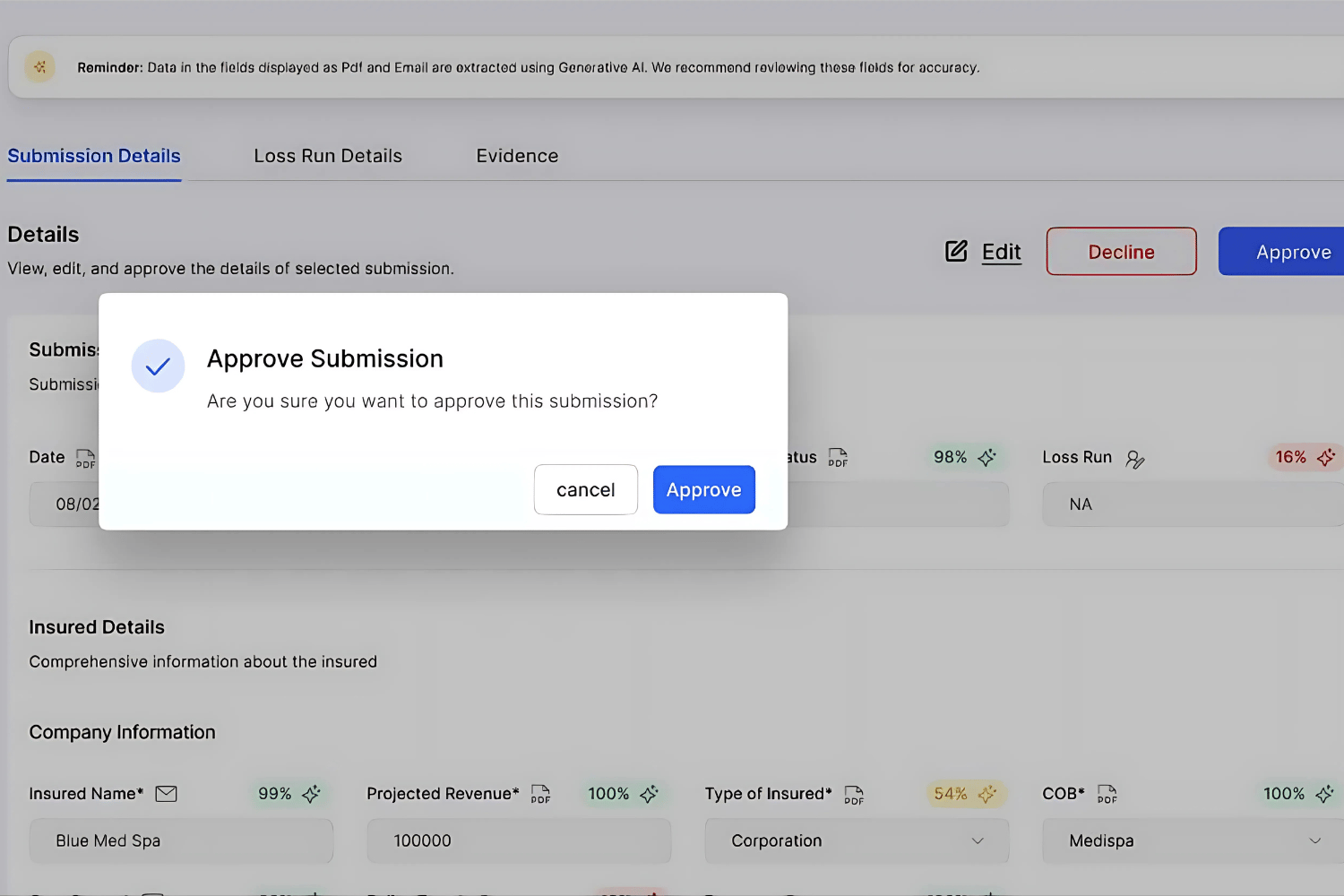

Decision point

From the same screen, underwriters can approve, reject, or request modifications.

Every decision is backed by the extracted fields + source documents.

Confidence scores (e.g., 98% accurate data match) help your team decide faster without second-guessing.

What will your team get?

Buttons that directly log the decision, with a “why” trail for audit.

Continuous feedback & adaptation

Every decision feeds back into the system, improving the AI’s future confidence.

Admins can adjust thresholds, add new fields, or create different approval paths by LOB (Line of Business).

What will your team get?

Custom dashboards that reflect your underwriting style, not a generic template.

Early adopters of Underwrite.In are already seeing these changes:

Processing speed is up by 85%

Handling costs down by 60%

Accuracy at 3x the industry norm

The sooner your team flips the switch, the sooner the inefficiencies vanish.

Team Underwrite.In