- Underwrite.In

- Posts

- Your insurance company can go bankrupt...

Your insurance company can go bankrupt...

But Causal AI can save you

🔍 Zooming in on:

Why is your company at risk?

How can AI help?

Remember the Equifax credit score debacle?

Millions of people ended up with wrong credit scores, all because a system glitch went unnoticed.

And who faced the consequence? The company.

Massive financial losses, reputational hits, and a ton of regulatory headaches.

Now, imagine you’re underwriting complex risks: multinational liability, cyber exposure, or industrial asset portfolios.

The sheer volume of data, the hidden interconnections, and subtle patterns are just too much for humans alone to catch.

So, if you miss even one anomaly, you’ll risk multimillion-dollar exposures.

But AI can help you (if you know about the right tool)

Here’s how…

Underwriting often misses systemic vulnerabilities because traditional risk models treat events in isolation.

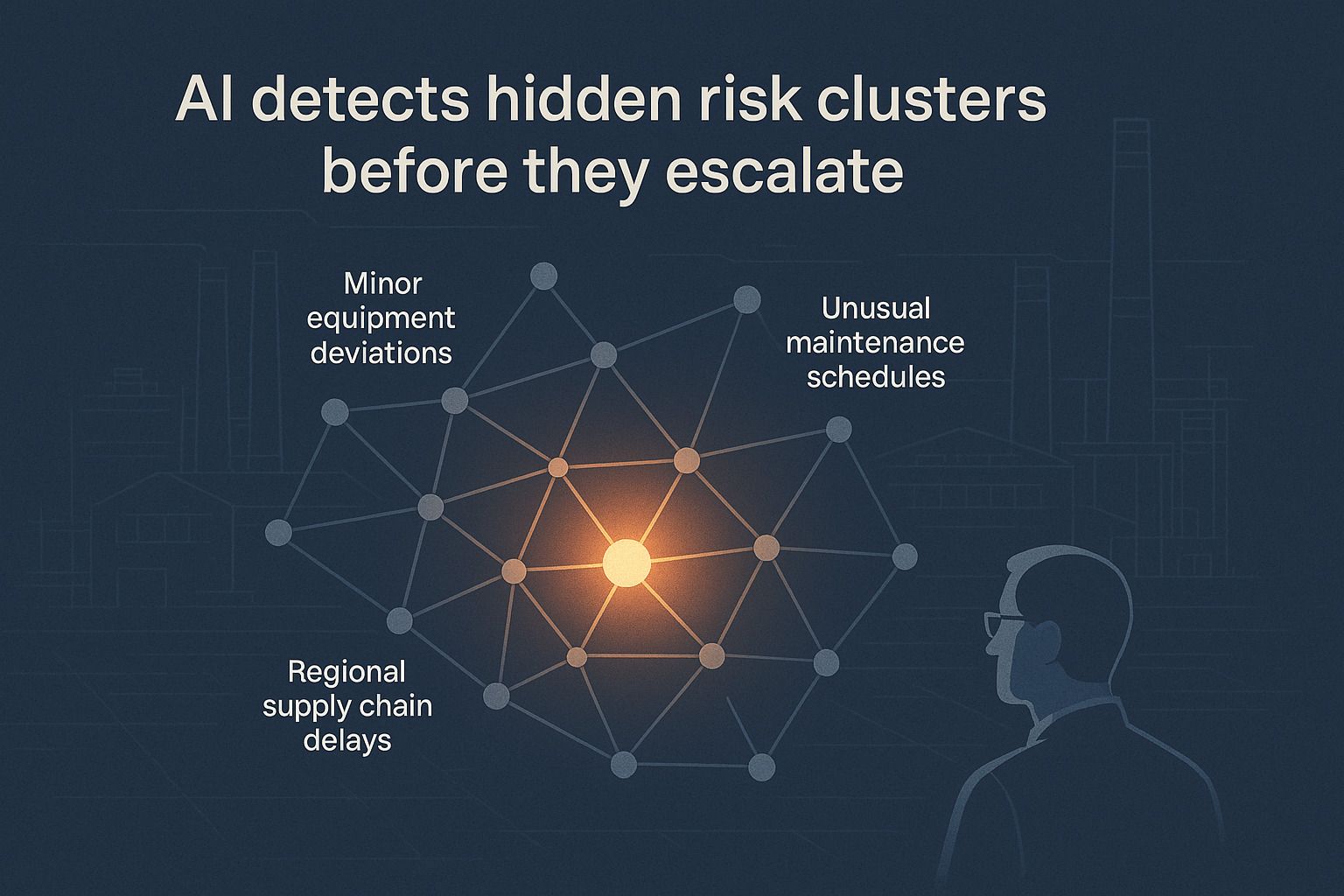

However, Causal AI identifies emergent risks where multiple low-severity factors interact to create high-severity outcomes.

For example:

In industrial underwriting small deviations in machine calibration, minor variations in raw material quality, and geographically correlated supply chain delays may individually appear harmless.

But, AI can quantify the compounded probability of equipment failure, regulatory non-compliance, or delayed production.

In short, it can provide insights that often require decades of human experience.

It can help map interconnections

Human analysts can map dependencies, but only at a limited scale.

Causal AI uses graph-based analytics to evaluate thousands of nodes simultaneously.

It can:

Assign probabilistic weights to supplier, client, and environmental interdependencies.

Identify indirect ripple effects across subsidiaries, regions, or global supply chains.

Simulate network stress under extreme conditions (like simultaneous supplier default + extreme weather + regulatory shock).

For example:

A single supplier delay in semiconductors might seem minor, but AI can reveal how it amplifies operational risk across multiple production lines, affects contractual obligations, insurance claims, and geopolitical risk.

It will give you the exact answer you seek

Correlation-based models are blunt instruments, they can tell you two events occur together but not why.

Whereas, Causal AI uncovers mechanistic relationships between risk factors.

It can:

Justify premium pricing with defensible, explainable reasoning.

Structure coverage to address underlying drivers, not symptoms.

Anticipate non-linear risk interactions that traditional models ignore.

But…

The cost of implementing causal AI is steep 👇

Still, a recent McKinsey study says, “companies that employ causal AI techniques in pricing decisions generate 3-8% higher returns than those using conventional approaches.”

You can still avert the cost and reap the benefits if you let Underwriting.In help you.

Underwrite.In goes beyond traditional automation by integrating Causal AI at every step:

Enhanced data extraction: Our AI bot extracts data from submitted documents with near-perfect accuracy, flagging any inconsistencies before they impact risk assessment.

Field accuracy monitoring: Every critical field like insured name, type, and policy details is verified for precision, ensuring that your decisions are based on 100% reliable data, not approximations.

Causal insights: By analyzing relationships between variables, our AI uncovers hidden risk clusters and predicts how small deviations can propagate across operations, suppliers, and portfolios.

With a team boasting 20+ years of underwriting experience and 10,000+ successful applications processed, Underwrite.In combines human expertise with AI precision, so you can make smarter, faster, and defensible decisions.

So, why wait?

Lastly, it’ll prepare you for the future

Most models fail to capture “black swan” events. Causal AI can simulate thousands of “what-if” scenarios:

Once-in-200-year floods

Coordinated cyberattacks across multiple subsidiaries

Simultaneous industrial failures across supply chains

By stress-testing portfolios against these extreme scenarios, AI identifies latent vulnerabilities and guides mitigation strategies, improving both solvency and profitability.

To sum it all up…

Complex risk underwriting isn’t about predicting the future; rather, it’s about understanding it more accurately than ever before.

AI gives you that edge, and Underwrite.In wants to be the one who will help you implement it thoughtfully, ethically, and alongside your judgment.

Team Underwrite.In